Financial Planning

The goal of financial planning is to ensure that you can meet your financial needs and objectives, both now and in the future. Financial planning is the process of evaluating your current financial situation, setting short- and long-term financial goals, and developing strategies to achieve those goals. It involves a comprehensive analysis of various aspects of your financial life. At Integra, financial planning is a collaborative process between you and your advisor.

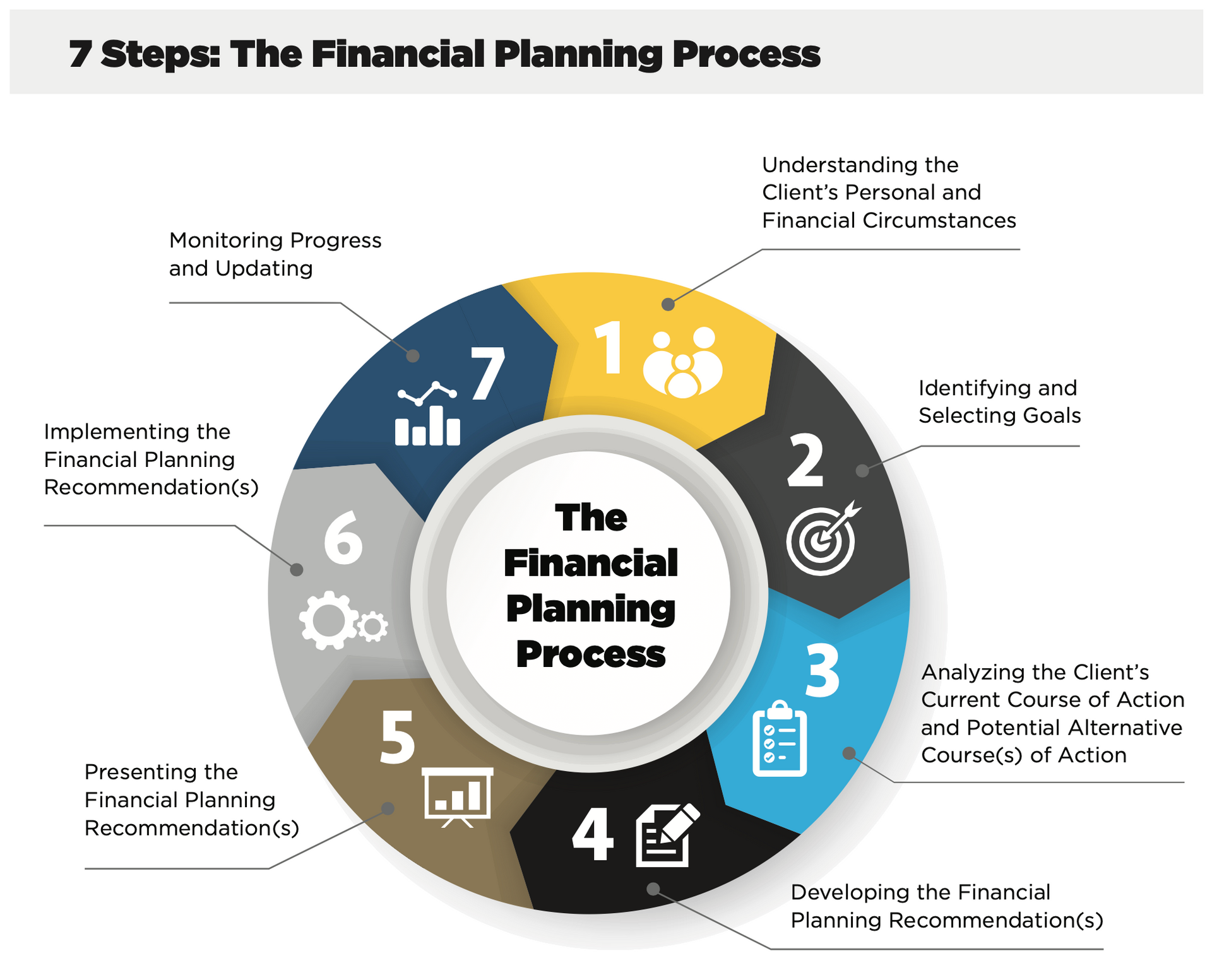

Source: CFP Board

Financial Planning Process

Integra follows the CFP (Certified Financial Planning) 7 step process as shown on the infographic to the left. This process is a collaboration between the advisor and the client. The advisor will consolidate all the client's information qualitative and quantitative, process it, and analyze it, and create a step-by-step method to achieve the client's goals.

7 step process:

- Understand the client's personal and financial circumstances

- Identify and select goals

- Analyze the current course of action and potential alternative courses of action

- Develop the financial planning recommendations

- Present the financial planning recommendations

- Implement the financial planning recommendations

- Monitor progress and update

We use Right Capital technology to build our financial plans:

- Sample Financial Plan - Millennial

- Sample Financial Plan - Pre-Retiree

- Sample Financial Plan - Retiree

What is a CFP?

A Certified Financial Planner (CFP) is a professional designation awarded to financial advisors who have met rigorous education, training, and ethical standards set by the Certified Financial Planner Board of Standards, Inc. (CFP Board). Here are some key points about CFPs:

- Comprehensive Knowledge: CFPs have in-depth knowledge of various aspects of financial planning, including investments, retirement planning, estate planning, tax law, and insurance.

- Certification Requirements: To become a CFP, candidates must complete specific coursework, pass the CFP exam, accumulate relevant work experience, and adhere to a strict code of ethics.

- Fiduciary Duty: CFPs are held to a fiduciary standard, meaning they are required to act in the best interests of their clients at all times.

- Ongoing Education: CFPs must continue their education to maintain their certification, ensuring they stay current with the latest financial planning practices and regulations.

CFPs provide comprehensive financial planning services to help individuals manage their finances and achieve their financial goals.