By Willis Ashby

•

January 14, 2025

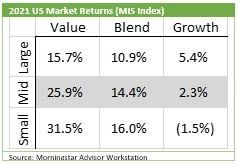

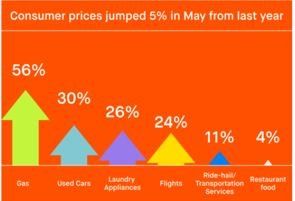

Happy New Year! We hope you had a wonderful holiday season and wish you prosperity, good friends, and good health for 2025 and beyond. We are pleased to report that the broad Morningstar index increased by 24.09% for the year and 2.57% in the fourth quarter. The "growth" segment of the market, particularly companies like Apple, Microsoft, NVIDIA, Amazon, Alphabet, Meta, and Tesla, has been a major contributor to this performance. Together, these seven companies are valued at approximately $17.92 trillion, which represents around 44.80% of the S&P 500. Their performance remains a significant driver of broader market trends. Several key events have recently influenced the financial landscape: The post-election “Trump Rally.” Bitcoin's significant rise, recently reaching around $100,000. Potential tariffs and their uncertain effects. Government debt interest payments surpassing defense spending, ~$1 trillion vs ~800 billion respectively. A notable increase in government employment in 2023, with 709,000 jobs added, a jump from 299,000 in 2022 and 392,000 in 2021 (source: www.bls.gov). The establishment of the Department of Government Efficiency (DOGE). The full impact of these events is still unfolding, but potential risks to market stability include tariffs, government debt, and the new DOGE department. While tariffs could have far-reaching effects, it is important to recognize that the policies discussed during campaigns may not align with actual implementation. Government debt may not pose an immediate concern, but over time, the bond market may react to the growing debt load, leading to necessary spending cuts. Though such measures could be painful in the short term, they may be necessary for long-term economic stability. The potential impact of the Department of Government Efficiency remains unclear. Elon Musk’s restructuring of Twitter (now X), which resulted in the elimination of thousands of jobs, has been seen as an effort to increase efficiency. Historically, the closure of government departments has been rare; the only significant example occurred during the Carter administration, when Alfred Kahn successfully dismantled the Civil Aeronautics Board (CAB), leading to lower airline prices and more travel options. Overall, we expect the companies we monitor and invest in to remain profitable. Despite potential disruptions, 2025 is likely to be another positive year for the market, though some volatility or "jolts" along the way should be anticipated. Enclosed is our annual privacy notice (mailed letters). Additionally, if you would like a copy of our ADV, it is available on our website or can be sent upon request. Lastly, I want to express my gratitude to Kathy, Nick, Keith, and Alison for their excellent work. Please feel free to contact us with any questions or concerns. We remain committed to providing the best financial advice to support your well-being. Sincerely, Willis Ashby, President Integra Financial, Inc. 5105 DTC Parkway, Suite 316 Greenwood Village, CO 80111 303-220-5525 / 303-689-0973 FAX Bureau of Labor Statics, Wall Street Journal, 1 st Trust, Morningstar, Zacks Research, Co-pilot &/or ChatGPT